Money, Power, and the People

The American Struggle to Make Banking Democratic

9780226636337

9780226636474

Money, Power, and the People

The American Struggle to Make Banking Democratic

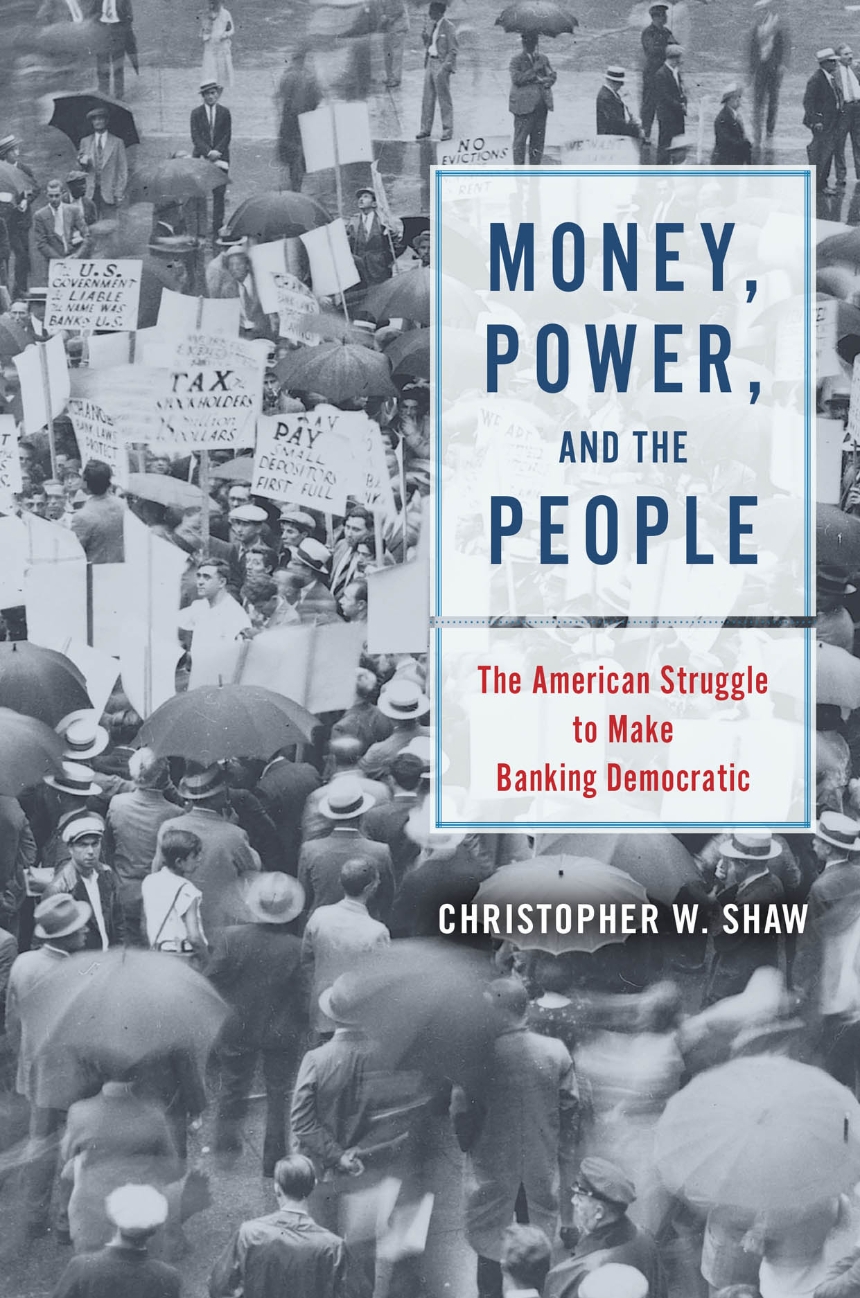

Banks and bankers are hardly the most beloved institutions and people in this country. With its corruptive influence on politics and stranglehold on the American economy, Wall Street is held in high regard by few outside the financial sector. But the pitchforks raised against this behemoth are largely rhetorical: we rarely see riots in the streets or public demands for an equitable and democratic banking system that result in serious national changes.

Yet the situation was vastly different a century ago, as Christopher W. Shaw shows. This book upends the conventional thinking that financial policy in the early twentieth century was set primarily by the needs and demands of bankers. Shaw shows that banking and politics were directly shaped by the literal and symbolic investments of the grassroots. This engagement remade financial institutions and the national economy, through populist pressure and the establishment of federal regulatory programs and agencies like the Farm Credit System and the Federal Deposit Insurance Corporation. Shaw reveals the surprising groundswell behind seemingly arcane legislation, as well as the power of the people to demand serious political repercussions for the banks that caused the Great Depression. One result of this sustained interest and pressure was legislation and regulation that brought on a long period of relative financial stability, with a reduced frequency of economic booms and busts. Ironically, this stability led to the decline of the very banking politics that brought it about.

Giving voice to a broad swath of American figures, including workers, farmers, politicians, and bankers alike, Money, Power, and the People recasts our understanding of what might be possible in balancing the needs of the people with those of their financial institutions.

Yet the situation was vastly different a century ago, as Christopher W. Shaw shows. This book upends the conventional thinking that financial policy in the early twentieth century was set primarily by the needs and demands of bankers. Shaw shows that banking and politics were directly shaped by the literal and symbolic investments of the grassroots. This engagement remade financial institutions and the national economy, through populist pressure and the establishment of federal regulatory programs and agencies like the Farm Credit System and the Federal Deposit Insurance Corporation. Shaw reveals the surprising groundswell behind seemingly arcane legislation, as well as the power of the people to demand serious political repercussions for the banks that caused the Great Depression. One result of this sustained interest and pressure was legislation and regulation that brought on a long period of relative financial stability, with a reduced frequency of economic booms and busts. Ironically, this stability led to the decline of the very banking politics that brought it about.

Giving voice to a broad swath of American figures, including workers, farmers, politicians, and bankers alike, Money, Power, and the People recasts our understanding of what might be possible in balancing the needs of the people with those of their financial institutions.

400 pages | 1 halftone | 6 x 9 | © 2019

Economics and Business: Economics--History

History: American History

Political Science: Political Behavior and Public Opinion

Reviews

Table of Contents

Introduction

1 The Bankers’ Panic of 1907

2 The Emergency Currency Act

3 Financial Heterodoxy Gains Ground

4 Central Banking and Agricultural Credit

5 From Armistice to Depression

6 The 1930s Banking Crisis

7 The Emergency Banking Act

8 The Banking Act of 1933

9 Government Programs and Mutual Aid

10 The New Deal for Farmers and Workers

11 The Banking Act of 1935

12 The Decline of Banking Politics

13 The Fall of Banking Politics

1 The Bankers’ Panic of 1907

2 The Emergency Currency Act

3 Financial Heterodoxy Gains Ground

4 Central Banking and Agricultural Credit

5 From Armistice to Depression

6 The 1930s Banking Crisis

7 The Emergency Banking Act

8 The Banking Act of 1933

9 Government Programs and Mutual Aid

10 The New Deal for Farmers and Workers

11 The Banking Act of 1935

12 The Decline of Banking Politics

13 The Fall of Banking Politics

Epilogue

Acknowledgments

Notes

Index

Acknowledgments

Notes

Index